Not every element available in that loan package usually match your demands, but the a lot more autonomy you can get to, the higher, particularly when your private affairs transform.

Check out of your has you need to look out for in a mortgage that can easily be useful in any special occasion:

Capacity to generate more repayments

And make more costs will assist you to save well on your residence loan fundamentally since these best ups go close to your own dominating. However, make sure your bank doesn’t fees for additional repayments.

For added comfort, ask your bank if you possibly could generate money via direct debit, ATMs, internet sites and you will cell phone banking functions.

Restoring your costs can give you confidence as your repayments will still be a similar monthly to possess a time. This will be useful if you want to end up being rigid into the your budget.

Whenever choosing home financing, ask your financial if they enables you to enhance their entire mortgage or perhaps a portion of it free-of-charge. This will help you greatly into the planning your budget.

Offset accounts

A counterbalance account will save you towards the focus can cost you – it functions for example a top-desire savings account in which financing try accounted everyday against your loan balance. In that way, the amount of principal are charged with appeal try shorter.

Loan portability

Financing portability is also an important element, particularly if you think you will be selling your house so you can improve towards the a bigger one to across the next many years. Portability will help you to maintain your existing organization connected with their home loan and give a wide berth to the fresh place and you may apps costs.

What assessment cost tell you about the mortgage

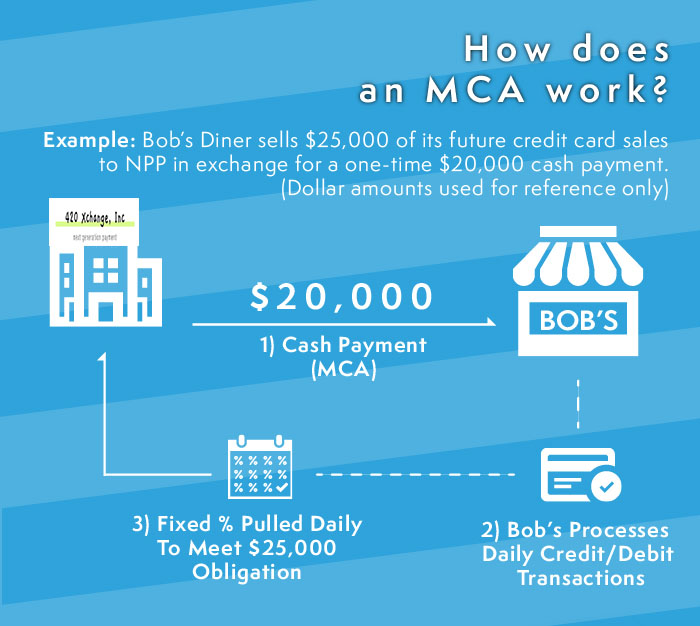

Examining new investigations price otherwise a home loan can present you with a concept the way it differs from almost every other funds in the business.

Evaluation prices let consumers select the genuine price of a loan. It will be the speed that includes both the interest rate and you can charge and charges based on financing, less to a single percentage contour.

People should take a look at assessment speed due to the fact if you’re loan providers can get encourage just what seems to be a highly low-rate, brand new assessment price is short for this new truer cost of the mortgage.

Ergo, a rival which have a higher advertised rate and you can less assessment speed might possibly be a cheaper option across the label away from a financing.

However, if you find yourself analysis rates are helpful, homeowners will be apprehensive about evaluation speed polishingparison speed polishing are if the lender just includes put fees on the evaluation rates formula and might establish adjustable costs moreover. This makes it important to find the correct bank and ask particular questions to learn most of the nooks and you can crannies out-of an effective home loan.

What are best lender

If you curently have a trusted bank, it might be best to begin to ask them to have suggestions regarding the mortgage brokers. This will not only become easier, it is going to save you perseverance since you have come transacting together with your financial for several purposes.

If you think discover greatest and online payday loan Ohio a lot more competitive home loan situations outside the lender, then is appearing having fun with mortgage analysis internet sites.

Learn doing you could potentially on the subject often of the website or by word off throat. Often the best way of finding the best financial bank is away from someone who currently works with all of them and advises all of them.

Anything you should also pose a question to your bank throughout the is where post-payment issues is actually treated. Does the financial institution provides customer support specialists offered otherwise are these specific things taken care of from the a trip centre or message service?