Your debt-to-income proportion (DTI) means an effective borrower’s obligations installment strength with regards to their overall monthly earnings. Meaning, how much cash out-of somebody’s monthly earnings gets into paying aside their expenses. That it ratio facilitate the lending company or a lending institution determine this new borrower’s power to pay off the new finance. A low proportion suggests that the fresh expense are now being paid with the big date. So it draws so much more lenders, as it suggests brand new borrower doesn’t have a lot of bills. At the same time, a top ratio is actually a sign of lower than-level financial fitness. This is going to make obtaining financing hard and high priced.

Debt-to-earnings ratio calculator

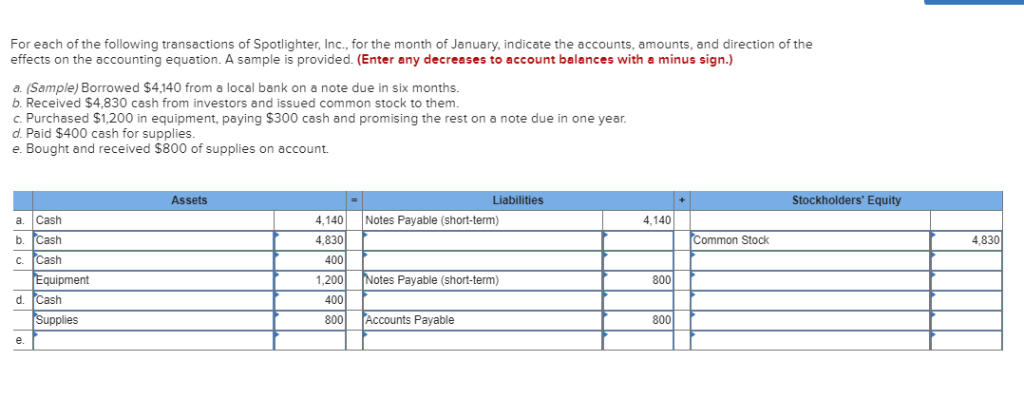

It sounds tough, but figuring DTI is not difficult. Create any monthly loans payments and separate all of them by the monthly revenues. Revenues ‘s the earnings you earn ahead of spending taxation and other write-offs. So you can determine their month-to-month costs, are the pursuing the: month-to-month book, EMIs, home/auto/medical mortgage, financial, credit cards, or other debts.

Such as, guess your complete monthly income is actually Rs. 1,50,000. Your own overall debt obligations into week was 50,000. After that your debt-to-income ratio is (500)*100 = %. This shows % of the earnings goes to brand new fees from expenses.

What’s good personal debt-to-money proportion?

The low your debt-to-money ratio, the greater it is. This indicates you’ve got less bills to repay. And therefore, this is going to make the financing approvals smoother and you can faster. Although not, good financial obligation-to-earnings proportion will generally vary from bank to lender. Fundamentally, a great DTI ratio all the way to forty% is considered right for mortgage approvals. DTI percentages more than forty% gets fund, but the attention billed was higher. However, remember that this is simply one of several many parameters when deciding to take a personal loan.

A high DTI ratio can impact debt lifetime in one single or more indicates. Let us look at how it could affect you.

- If DTI proportion try higher, they shows you is purchasing a more impressive the main money paying down expenses. It indicates you will find a lot fewer coupons and you will investments.

- Increased DTI proportion reduces the likelihood of bringing money. This is exactly a problem during the a crisis.

- People with a high DTI ratio normally safe that loan, but the attention charged because of the loan providers might be for the large top.

Ideas on how to Lower a debt-to-Money Ratio

Which have a monetary package is very important with regards to reducing the obligations-to-income proportion. Be sure to be aware of the money you owe and costs. Less DTI ratio ensures that you could safe a loan afterwards in case it is really important.

- Postpone a purchase whether americash loans Whatley or not it is not an emergency. This can cut down on credit card debt. When there are less instructions on the credit, it does lessen the financial obligation-to-money ratio of the individual.

- End taking on a whole lot more personal debt unless of course their proportion falls lower than forty%. Pay-off all your valuable debts, whenever possible. Repaying bills support alter your credit utilisation price. So it then improves your credit score.

- Closure previous money might help too. Some people combine all their numerous highest-desire costs towards one to and you may consolidate all of them by firmly taking a personal financing.

- Boost EMI money to end the latest debts quickly. This helps in the long run.

- See most types of money, when possible. Interested in a side hustle, providing online classes, otherwise concentrating on sundays may help improve income.

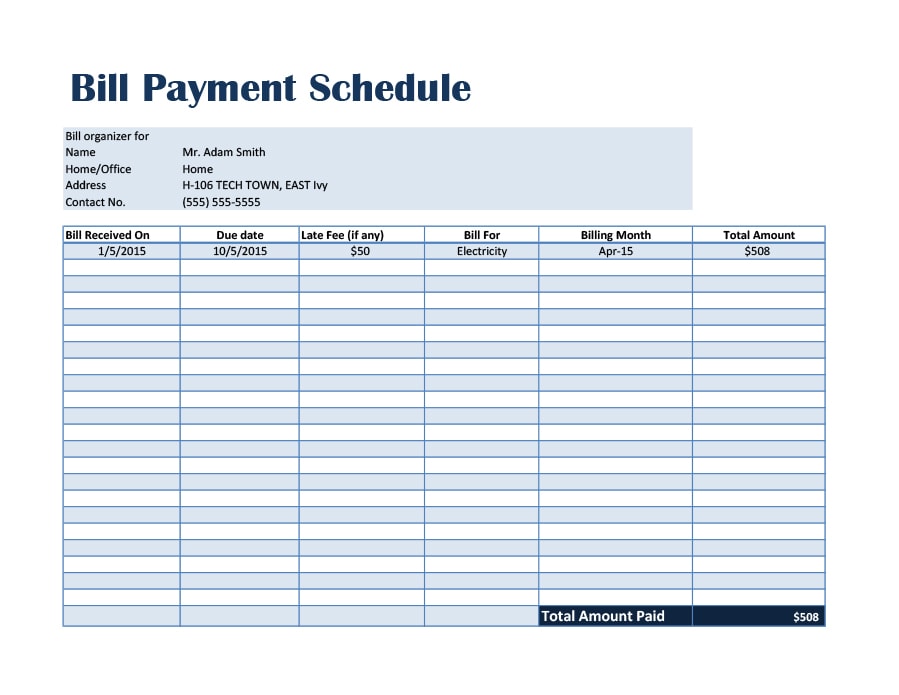

- Assess the debt-to-income proportion monthly. This will help in the keeping track of and you may focusing on how the debt is managed. There are what is actually in its go for to save the DTI proportion lower. It is extremely encouraging observe the latest expense being managed inside the a held means.

The thing that makes the debt-to-income ratio extremely important?

The latest DTI ratio facilitate the lending company scale the loan installment ability. They tells simply how much of one’s month-to-month earnings is certian into the cleaning of costs. In addition, it affects your credit rating, and therefore a lender takes into account if you’re granting finance. A reduced personal debt-to-earnings proportion increases your chances of taking that loan.

A great DTI ratio signifies that the latest borrower’s monetary fitness is actually in good shape. Meaning he or she is capable safer another type of loan and additionally be capable pay it back instead defaulting.

Really does your debt-to-earnings ratio affect the credit history?

Your debt-to-earnings ratio has a secondary influence on your credit rating. A lender will not know what your disgusting money was. Thus, they can’t make specific calculations. Nevertheless they would have a look at exactly how much borrowing from the bank you’ve got. They compare your mastercard account stability toward sum of all borrowing from the bank limitations on your own notes. A loan provider will be more finding the debt history of the newest debtor than its money background. Still, to help you safer financing effortlessly, keeping a healthy DTI proportion can be as useful just like the an excellent credit rating.

Achievement

To close out, your debt-to-earnings ratio can benefit the lender while the debtor. Whilst shows the connection between someone’s earnings and costs, it can help the financial from inside the determining the fresh new borrower’s installment potential. So that as just one, by figuring DTI, one can possibly get a hold of its expenses and work at them. You could potentially opinion your financial situation per month and find a means to all the way down all of them. This can be done from the often dealing with your own expenses otherwise expanding your income. For lots more money-associated information, you might head to Piramal Funds and read significantly more articles.